On September 19, the development and reform commission (NDRC) released the guidelines for the price behavior of the operators of shortage drugs and API (draft guidelines). This is the first time in the national development and reform commission market shortage of drugs and drug ingredients price behavior normative guidelines, mainly in order to curb the illegal operator on the grounds that the shortage of drug shortage of drugs and drug ingredients to rise in price, malicious control pin, etc, in order to maintain our shortage of fair competition in the field of active pharmaceutical ingredients and drug products and price order, protect the interests of consumers, ensure medical health system reform was deepened.

The promulgation of the "guide", will make the future development and reform commission (NDRC) tend to rectify market shortage of drugs and drug ingredients, but also makes the enterprise to lose by a shortage of medicine research and development to declare the possibility of obtaining high returns, so that the enthusiasm of enterprise layout and shortage of medicine has fallen.

How to define a shortage?

Before the "guide" was released, there was no policy document to define the shortage of medicines.

The shortage of medicines can be divided into two categories: one is the absolute shortage of medicines, including those which have been eliminated by natural selection due to the changes in the disease spectrum and the normal replacement, and the pharmaceutical enterprises that have ceased production. The other is a relative shortage of drugs, mainly refers to some drugs, though still have production supply, but because of geographical, countless information, mode of operation, such as the limited production causes parts or part of a period of time can not meet the clinical need.

According to the definition of "guide", shortage of drugs is to point to in a certain area can't normal supply of drugs, including traditional Chinese medicine, Chinese medicine yinpian, proprietary Chinese medicine, active pharmaceutical ingredients and their preparations, antibiotics, biochemical drugs, radioactive pharmaceuticals, serum, vaccines, blood products and diagnostic products, such as the API is used in the production of chemical or natural ingredients of pharmaceutical preparations. It is clear that the "guide" is more concerned with medicines that are still in short supply.

According to "guidance", two aspects need to be defined: one is the substitutability of product production, and the other is the contradiction of regional supply and demand.

Substitutability of product production, considering the substitutability of drugs and substitutability of production. Drug alternative includes drug function attributes, the difference of price, sales channels, paid subject, clinical application preferences and use main body to the drug dependence, API also need to consider the preparation of reagents or terminal drug varieties can type, purpose, treatment effect, etc. This means that the definition of shortages will take into account clinical needs.

Production of alternative to consider other pharmaceutical production enterprise for production qualification, the transformation to the difficulty of the production facilities or process technology input costs, risks, production need time and halt production after the market competitiveness of the product supplied. This is more from the perspective of changing the production area, the listing license holder MAH system will hopefully solve the problem of the shortage of individual products.

The contradiction of regional supply and demand is considered from the regional circulation supply. Most demanders choice drug practical areas, different areas of drug regulatory policy, tax policy and other regional operators, environmental requirements and supply or sell the immediacy of the drug, the contradiction between the feasibility, is the key defined factors.

Are shortages of drugs inevitable?

In addition, when information asymmetry is difficult to effectively qualitative analysis, also can take 2009 years "the antimonopoly commission on relevant market definition guide to assume that the monopolist in the tests as defined standards.

The judgment standard for other goods sales conditions under the condition of unchanged, assume that monopoly can persistently (usually 1 year) slightly (5% ~ 10%) to improve the target prices of the goods, and the goal after the commodity price increases, even assuming that monopoly sales drop, but if it is still profitable.

This means that the shortage of pharmaceutical production is in short supply and is expected to form a "monopoly" of drug, the drug due to its scarcity, commodity prices are likely to be able to raise prices to obtain high profits, as the terminal prices continue to rise in price is greater than or equal to 5%, would be likely to trigger a cordon. That is to say, the annual price increase of the shortage drug should not exceed 5% and be reasonable.

The definition of the NDRC is not the absolute price of the price increase but the price increase. In the case of the case of the monopoly agreement of beinitol tablets, the average price of the sales of the market for the other products was about 5.8 yuan/bottle (0.1 grams x 100 tablets/bottle) from 2012 to 2013, and up to 10 yuan/bottle in early 2014. In fact, the price per piece rose to 0.042 yuan, but the increase of 72 percent caused the NDRC's attention. In April 2014, the parties agreed to raise the price to no less than 18 yuan/bottle; In December 2014, the parties negotiated and decided to raise it to 23.8 yuan per bottle from January 2015. The case was eventually awarded in violation of article 13 of the anti-monopoly law.

For lower-priced products, especially for each pill under $3, the limited price increase will curb the consistency of the manufacturers of the drug-related shortage.

Three types of restrictive behavior standards

Production, sales, shortage of active pharmaceutical ingredients and drug related market main body (the operator) in the "guide" limited by the behavior of the main can be divided into illegal price behaviors, three classes of monopoly agreements, abuse of dominant market position. Content involved in the enterprise behavior, most agree with the anti-monopoly law, but there is no "concentration", namely the control enterprise merger, restructuring mergers and acquisitions behavior of these drugs are not limited.

The restriction of illegal price behavior mainly includes: fabricating, spreading price increase information; Hoarding and selling at high prices; To collude and manipulate the market price; Implement price gouging.

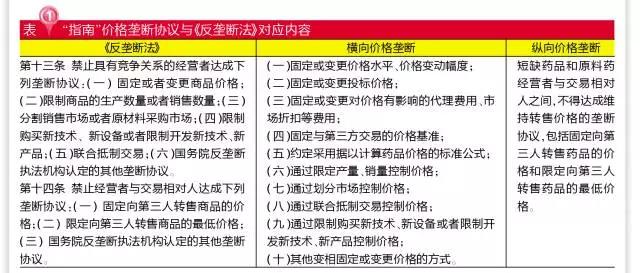

Monopoly agreements refer to agreements, decisions, or other collaborative behaviors that exclude or restrict competition. The form of a monopoly agreement can be either express or implied, including but not limited to a monopoly agreement reached through written, oral, email, WeChat, SMS, etc. The monopoly agreement is divided into horizontal and vertical, corresponding to the 2007 anti-monopoly law of the People's Republic of China (" anti-monopoly law "), 13 and 14. This is the first time that China has targeted the drug monopoly agreement in a targeted way, and the future manufacturers will be targeted by the national development and reform commission (NDRC) for the exclusive bidding of the two or five sub-regional markets.

The comprehensive consideration that determines the market dominance of the operator is basically consistent with article 18 of the anti-monopoly law. After the comprehensive evaluation, the article will refer to article 19 of the anti-monopoly law, namely, "(1) the market share of one operator in the relevant market reaches half; (2) the two operators in the relevant market share a total of two-thirds of the market share; The market share of the three operators in the relevant market is up to three quarters. If the circumstances of the second and third provisions of the preceding paragraph are specified, and the market share of some operators is less than one tenth, the operator shall not be presumed to have the dominant market position. Is presumed to have dominant market position of the operator, there is evidence that does not have a dominant market position, not its dominant market position shall be deemed as ", as the standard of operators have a dominant market position. Thus, market concentration is the key criterion.

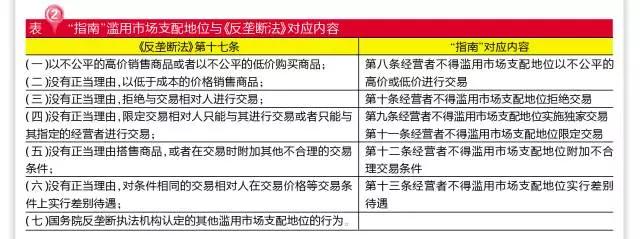

The six ACTS of abusing the dominant position of the market are basically consistent with article 17 of the anti-monopoly law. Among them, "in a stable market environment, the cost is not affected by the significant cases, exceed the scope of normal profit increase in selling prices or reduce the purchase price" for determining price "unfair" and "unfairly low" one of the judgment standard, but what is a normal profit, "guide", there is no detail, it is still the standard the development and reform commission (NDRC) is given.

The terms of the waiver are noteworthy

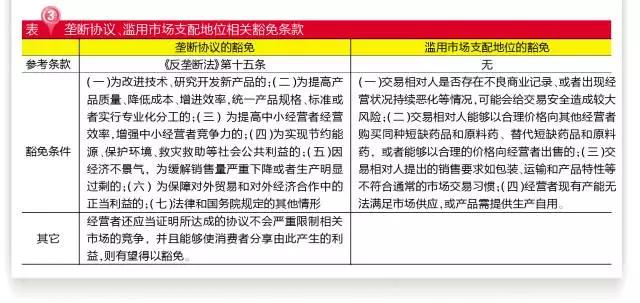

It is particularly noteworthy that there are relevant exemptions for monopoly agreements and abuse of market dominance.

New dosage forms for improvement or the synthesis of new path products, small and medium-sized operators of unity, unified product specification in the unified production and take delivery and payment terms agreement, etc., are expected to obtain the exemption of monopoly agreements, but must ensure that the interests of the consumers to share the resulting. In fact, reasonable restraints are conducive to reducing the production cost of enterprises, improving the quality of products and improving the productivity of enterprises, especially the agreement of the unified export price.

According to article 4 of the exemption of abuse of dominant market position, if the raw material pharmaceutical factory and pharmaceutical preparation is the same manufacturer, then when other apis manufacturer production, the factory can to the existing capacity can't meet the market supply "exclusive monopoly.

Conclusion the < < <

Restricted by domestic drug registration regulations, the domestic manufacturers to change API, the cost is higher, especially the consistency evaluation policy environment, such as changes to the API limits are growing even faster. Generally speaking, manufacturer of fixed and raw material drug manufacturer to sign an agreement, unless the cost that the original cooperation manufacturer provides is far above the industry level, otherwise do not change the original material medicine manufacturer casually. However, in recent years, due to the environmental protection law and the 2010 GMP upgrade, the concentration of raw drug manufacturers has increased, resulting in a monopoly phenomenon.

Visible from the "guide" the exemption conditions, concentration, especially the integration of upstream and downstream of the will is the breach of the policy limit, the integration of upstream and downstream shortage of drugs and drug ingredients will be the only way for generics industry upgrading. Consistency evaluation will lead to preparation plant number decrease, 289 directory products not to carry out the consistency evaluation rate more than 50%, and the manufacturer within five products are 60, API under reversed transmission, these products have become the possibility of shortage of medicine.

|