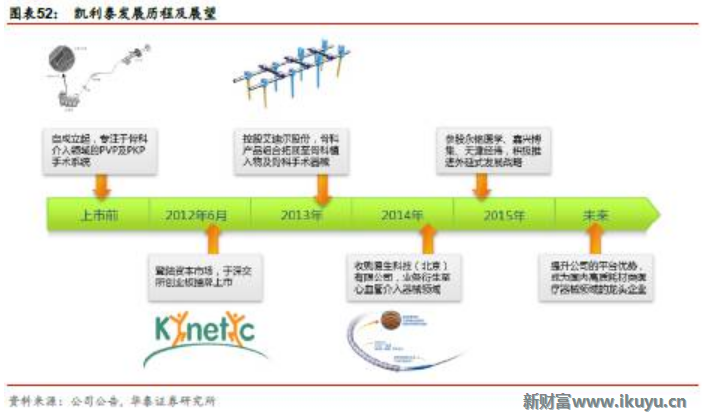

4.3.1 platform of high-value consumables enterprises with comprehensive competitive advantage

Company is the domestic research and development production vertebral body forming minimally invasive interventional surgery system leading enterprises, related technology reached the international advanced level, products are exported to Europe, Japan and other regulated markets. Company in 2013, 2014 m&a arc with the science and technology, in field of orthopedic implants and cardiovascular stents, to become the domestic high-value consumables direction across many product lines in the field of the company, has the comprehensive competitive advantage. Company revenues and profits over the past few years the rapid growth, but relative to the high value consumable market on a smaller scale, still has great potential for development in the future.

4.3.2 key business steady growth

Company main business for the orthopaedic (vertebral body shape of minimally invasive surgery system + orthopaedic implants) and two large categories of cardiovascular stents.

4.3.2.1 kelly orthopaedic business still has large market potential

Kelly's orthopedic mainly engaged in the vertebral body forming minimally invasive interventional operation system research and development, production and sales, products are mainly used for vertebral compression fractures caused by osteoporosis clinical minimally invasive surgical treatment of concrete including percutaneous vertebral body shape (PVP) operation system and percutaneous balloon expansion vertebral body system convex forming (PKP holds) after surgery. In 2013 the company holding shares arc, to expand the orthopaedic products to trauma and spinal implant field. Company of vertebral body forming minimally invasive interventional surgery instrument technology has reached the international advanced level, products PKP holds 16 years Japan permission. Kelly's to become the second overseas companies in addition to medtronic, its PKP holds the product allowed to enter the Japanese market, according to the excellent product quality and stability. PKP holds the products of the company covers more than secondary high-end hospital, domestic market share reached 30% - 30%, is in the lead. According to the osteoporosis China white paper estimates, vertebral compression fractures in our country, new onset of about 1.8 million people a year by 2020 to reach about 36 million the number of cumulative incidence. Every year and the current domestic vertebral body forming minimally invasive since about 25000 cases of left and right sides, market penetration and a lot of room to improve.

Comprehensive the above analysis, whether the company has the traditional advantage of PKP holds the product, or arc of orthopaedic implants have the very big development space. PKP holds the main products in a large hospital sales, second-tier cities and arc main products sales in lower-tier cities and grassroots hospital. Arc and kelly's products can register, and use different dealer channels, different bidding and pricing strategy to locate different customers, so as to realize the full cover of channels. We watch the orthopedics instruments company future development prospect.

4.3.2.2 kelly (easy) coronary stents business fast growth

Kelly's 14 years acquired breeds technology into the field of cardiovascular stents. Breeds of independent research and development of science and technology products "love set (Tivoli) drug-eluting coronary stent system" as "chromium alloy stent platform + biodegradable carrier/carrier free" the third generation of drug-eluting stents, the mechanical performance of big gains, biocompatibility and drug controlled release performance, reduce the problem of late thrombosis significantly affect stent safety. Easy to enter the listed company after the body with the advantages of platform and channel widening the winning area and rapid growth. Being less intelligent remained statistically significant base of science and technology at present in the field of cardiovascular stents lower (less than 5% market share), is expected to continued rapid growth in the future.

4.3.3 acquired ningbo deep - bo strengthen channel integration

In the national "two votes" under the background of policy implementation, instrument channel integration is the trend of The Times. Company through the acquisition of deep strategy wins bo makes channels sinks, so that they can maximize for product promotion and (research and development and acquisitions) new products on the condition, to enhance the company's competitive advantage. Deep strategy wins bo pledged 2017-21 years to female net income is not lower than 40 million yuan, 42 million yuan, 44.1 million yuan, 46.31 million yuan and 48.63 million yuan.

4.3.4 endogenous extension prospect, for the first time coverage, "overweight" rating

We predict the company core business of the existing 2016-18 annual income of 830 million yuan / 5.7/7.0, belong to the mother net income for 230 million yuan / 1.5/2.0. Moreover, suppose that deep strategy wins bo of the new m&a performance commitment (February 17 years and is expected to table), the merger to mother net income for 280 million yuan / 1.6/2.4, year-on-year growth of 28% / 53% / 16%, the current price corresponding valuation for 47/31/26 times. Considering the company's existing product line good growth potential, in vitro have multiple projects in the breeding, is worth looking forward to the future extension development. Company currently PETTM49 times, 17 years PE31 times, in the past three year low over the past three years (PETTM and PEForward lows of about 60 times respectively and 50 times).

Through the comparable company valuation analysis, kelly's average valuations in comparable companies, but the future net income growth and sales net interest rates far higher than the industry average, shall be given a certain premium valuation. To this end, we first cover, give the firm a 17 years after the merger performance EPS33 valuations, 37 times, target price 12-14 yuan, "overweight" rating.

Risk tip: high value consumable bidding price; Instruments channel integration progress than expected; In vitro project progress not exceeding the expectation ". (after)

Stock market risk, the investment need to be careful. This article only reference for the audience, do not represent any investment advice, any reference in this paper, the investment decision is made for audience to independence, the economic, financial or other risks by the audience from the bear.

|