| Micro-channel |

|

|

|

|

|

|

| |

| In the first three quarters of 2017, the number of pharmaceutical ipos in the third quarter of the market is a whopping 38, with over 100 VC/PE |

| |

| Author:中国铭铉 企划部 Release Time:2017-9-20 10:24:55 Number Browse:1622 |

| |

According to the statistics on September 20, only seven of the 38 enterprises have no VC/PE support. However, the number of investment institutions behind pharmaceutical companies is a common phenomenon, and there are more than 100 institutions behind these 31 enterprises.

Listed is not only to measure the achievements of each enterprise is the most important yardstick, but also as the main way of capital exit, for listed companies behind investment institutions not only profitable, also can enjoy the envious eyes.

According to the investment world, the number of ipos in 2016 was as high as 27, with at least two listings on average each month. Among them, China resources pharmaceutical raised about 12.56 billion yuan to win the title of "the largest medical enterprise IPO in Asian capital market in 2016"; The drugmaker, which shares its offering price of 55.88 yuan per share, has a bell on the title of the most expensive medicine unit. The company has been listed as the fastest listed company in the market, with just nine months to go.

After a seemingly frantic 2016, the medical carnival continues and goes to a new climax. By the end of the third quarter of 2017, the number of bio-pharmaceutical ipos has reached 38, with an average of at least four listings a month, almost double what it was last year.

38 listed in the biological medicine enterprise, the a-share 32 (Shanghai 12, extensively in all 20, including gem 15, and small and medium-sized plate five), Hong Kong, 5 (1 motherboard 3, gem), U.S. stocks (nasdaq stock exchange) one.

In addition, according to statistics, only seven of the 38 enterprises have no VC/PE support. However, the number of investment institutions behind pharmaceutical companies is a common phenomenon, and there are more than 100 institutions behind these 31 enterprises.

Generally speaking, 2017 is the time for many VC/PE organizations to focus on the biomedical field. At least two companies have been invested in ipos, including deep venture and CDH. As a "leader" of local venture capital, shenzhen venture has always been excellent in IPO performance. CDH has already invested in a number of listed companies in the field of biomedicine.

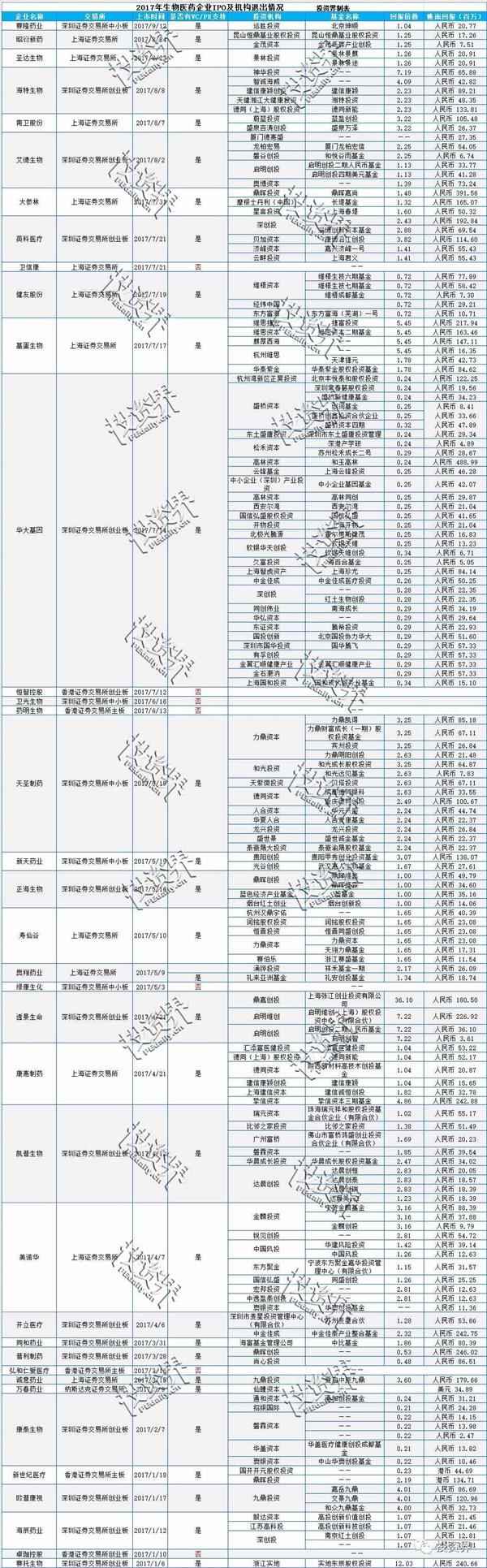

The investment community has sorted out the IPO industry of the biomedical sector in 2017 and the withdrawal of the investment institutions behind it. See the table below.

(investment return is calculated at the issue price, as of September 18)

Huarong gene: gene sequencing the first share of the gene that has been stolen by VC/PE

Deep venture chairman NiZeWang with "blood" to describe the venture capital markets: "previously raised 300 million ~ 500 million feel very great, there is no 5 billion yuan, fundamental said embarrassed to go out, money much more special, especially your project. Now the project is like 'match the warrior', who gives the price to whom.

Although through genomics IPO exit mechanism for more than 26, but, according to the prospectus before and after the investment institutions of nearly 40, to see how the capital genomics.

Since the opening of the big China gene, there have been 18 consecutive daily rise and stop, and then the stock price has been rising steadily. As of September 18, the shares were trading at 184.94 yuan per share, closing at 174.40 per share, up nearly 13 times from their ipo price of 13.64 yuan, with a market value of 69.3 billion yuan. Many of the investment institutions that might have been worried about the loss of their principal may have been more than happy.

Genomics was established in July 1997, the predecessor of genomics medical (shenzhen) co., LTD., is a leading global diagnosis of genomics research, by way of gene sequencing of biological samples for testing, analysis and interpretation, and the sequencing results are respectively established the sequencing, computation of mass spectrometry, genetic engineering, information technology platform, mainly for medical institutions, scientific research institutions, enterprises and institutions to provide genomics such diagnostic and research services.

On July 14, 2017, huayong gene successfully landed on the shenzhen stock exchange's gem board, and became the third leading listed company in shenzhen after tencent and shunfeng. The prospectus discloses that many well-known institutions, such as deep venture capital, tongchuang weiye, shengqiao capital, softbank huateng venture capital, gaolin capital and yunfeng fund, are among the list of shareholders.

In June 2015, genomics has carried on the last round of financing before listing, among them, the genes which, small and medium-sized enterprise investment in Shanghai, ningbo belt Collins, ChengQiao chong xin bo source, tianjin, xi 'an irvine, guosen hong sheng, Shanghai, ningbo softbank, open content, feng MAO investment clay creatures, and embellish investment, Jane, sea lilies, especially deep venture in Shanghai 15 agency company, ultimately get equity accounted for 8.34%.

Kangtai biology: 23 a word fluctuation of medicine demon shares, ask you fear not afraid?

It's crazy to think that huarong gene opens 18 trading days, but it's even crazier.

The first day of trading was 8.97 per cent, and from the second day onwards, 23 consecutive daily limit stops were not stopped. The shares, which are trading at rmb41.99 per share, closed at rmb37.00 per share as of September 18, more than 11 times the price of 3.29 yuan/shares, which is now worth 15.6 billion yuan.

Conde creature was established in 1992, the main business is to use vaccine research and development, production and sales, at present the main products are recombinant hepatitis b vaccine and haemophilus influenzae type b vaccine, measles, rubella combined live attenuated, cell free DPT joint haemophilus influenzae type b vaccine and other products.

On February 07, 2017, kangtai biology is listed in shenzhen gem board. According to the prospectus, it has been invested in various institutions such as xiang investment high venture capital, Beijing venture capital, iwlin capital, Australia silver capital, China capital and the bank of China.

One of kangtai's investors, iwlin capital has invested 140 million yuan to kangtai biology. Rock capital layout in the field of health care a lot, now has investment conde, cape, DE yi east, friends friends ChengNuoJi, cheese, cape, medical check-ups, intellectual compro medicine and biological, rainbow, and the children's hospital of Kyoto, and so on more than ten projects. Kapoor has landed on the gem on April 12.

The company, which is also owned by the company, is also successful in its IPO on the Shanghai stock exchange on April 7.

Penetration life: the price of the offering alone returns 36 times as much as the investment agency

According to the private equity data, the paper return of the IPO of the company is up to 36 times in the IPO price alone. For other listed companies in the field of biometric medicine, the price of the full view life is relatively high at 36.10 yuan per share. The share price of the life of transparency has also risen to 117.49 yuan/shares, which ended Sept. 18 at 91.70, with a market value of 5.5 billion yuan.

Perspective life founded in November 2003, its inception, through the scene life is positioning in the high-end research and development of diagnostic reagents, such as tumor early screening, and rely on fluorescent suspended lattice is streaming technology. After ten years of development, through life scene built high flux flow fluorescence hybridization technology platform, high flux flow immunofluorescence technology platform, multiple fluorescence PCR technology platform, chemiluminescence immunoassay technology platform, and many other technology platform. In the field of immune diagnosis, 20 kinds of tumor markers have been developed.

On April 21, it landed on the shenzhen stock exchange's gem board. According to the prospectus, qiming venture, another investment firm, has a combined stake of more than 7.38 million shares, with a 16.41 percent stake.

In fact, the life of the landscape is just a microcosm of the health field. In the 11 years since its inception, qiming ventures has invested in 60 companies in the medical field, covering a number of segments such as biopharmaceuticals, medical devices, diagnostic techniques, medical services, and life sciences.

Qiming investment perspective of life "traders" William hu believes that "the field of Chinese medicine and health, is in a period of market capacity and opportunities will no doubt continue to increase, but a feature of the pharmaceutical industry is the government or insurance company is the buyer, so vulnerable to the effects of government policy. Given these two factors, the underlying trend is the industry's cautious optimism, but the sub-industry is not evenly distributed.

conclusion

China's equity market in 2010-2016 biological medicine industry in general is a rising trend, case number average growth rate of 33.7%, investment amount average growth rate is as high as 89.0%, especially in 2015 and 2016, the pharmaceutical industry equity investment increased rapidly.

Whether new incoming or investors for many years, has focused on biological medicine investment holdings of basically the same tone: "biological pharmaceutical industry is a sustainable growth, behind potential big gold mine, a beat all the other industrial sectors of growth and counter-cyclical properties, can make the continuous appreciation of their invested capital".

As an industry closely related to residents' life, the pharmaceutical industry has a broad market and is highly technical and technical. It is a good investment target for VC/PE institutions. With the mature application of precision medical and bioengineering technology, single anti-drug will have great development space. The implementation of the two-ticket and sunshine procurement policy also provides development opportunities for pharmaceutical outsourcing companies (cmos, CSO, etc.); Traditional Chinese medicine is also under the support of the policy, ushered in the golden period. In the context of medical reform, the development of bio-pharmaceutical industry in China is entering the fast lane of regulation.

|

| |

Previous article:A total of 31 applications for clinical data on clinical data were verified

Next article:214 designated medical institutions in sichuan are connected to the country's long-distance medical treatment and settlement system (list)

|

| |

|

|